With the labor market becoming more competitive than ever, the skills needed to stand out also become even more complex. Hence, more individuals are choosing to improve their knowledge by pursuing further education and a lot of them choose to add more value to it by taking overseas programs.

Following this trend, Canada is one of the most-considered study destinations for students enrolling in graduate programs. In 2019, over 45,000 master’s and doctorate candidates were granted visas to study in Canada. Graduate students made up 13.8 percent of the total international student market in Canada.

In this article, let’s look at the countries where those students hail from.

Key Takeaways

- Graduate students make up around 13 percent of the total Canadian international student market

- China sends the most students for both master’s and doctorate programs in Canada.

- Francophone countries also send a significant number of graduate students to Canada because of the language advantage

- India has lesser students enrolled to graduate programs in Canada despite being the country’s largest international student market

Master’s Students Source Countries

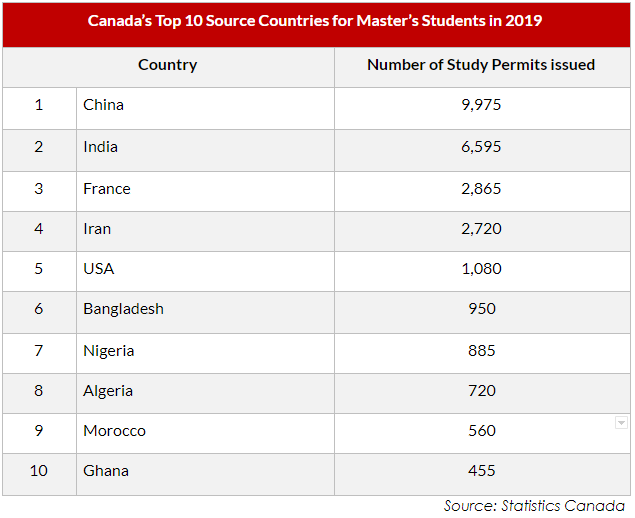

In 2019, 34,485 international master’s students were granted study visas in Canada. The dominant players in the greater Canadian international education market, India and China, led here as well.

In the same year, Indian students were granted 9,975 master’s degree study permits and extensions. Indian nationals made up 28.9 percent of international master’s students. While largely significant, India’s proportion of study permits across all sectors lagged at 34.6 percent. In 2018, master’s students made up 7.1 percent of Indian students in Canada.

Also, in 2019, the Canadian government granted 6,595 master’s study permits to Chinese students. This accounted for 19.2 percent of Canada’s international master’s student market. The year prior, 7.8 percent of Chinese students in Canada pursued master’s degrees.

With 2,865 study permits awarded to master’s students, France came in third. This accounted for 8.3 percent of the international master’s student market. In 2019, approximately 20 percent of French nationals studying in Canada were master’s students, in contrast to India and China.

Iran came in fourth place with 2,720 study permits given in 2019. This accounted for a whopping 27.8 percent of Iranian students in Canada. The United States completed the top five.

The top ten nations by the number of study permits issued are listed in the table below:

Top Sources for Doctoral Students

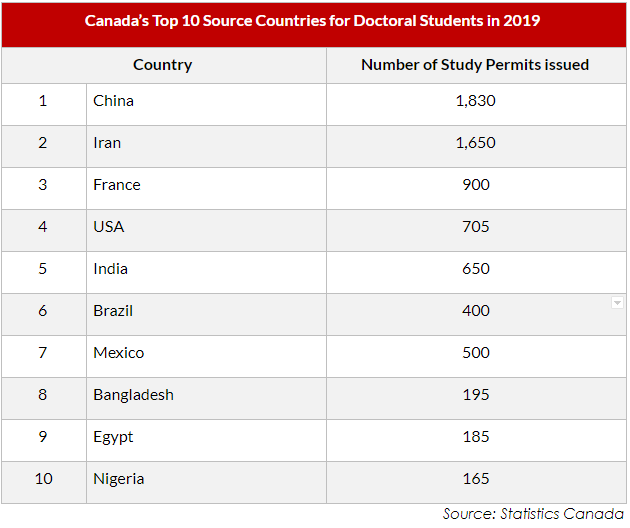

Canada’s international market for doctoral students is roughly 30 percent smaller than the market for master’s students. This reflects the fact that the doctoral sector accounts for a substantially smaller percentage of total graduate study.

China is Canada’s top source for doctorate students. In 2019, 1,830 Chinese nationals were granted study permits for doctorate studies, accounting for 17.3 percent of the global doctoral market.

With 1,650 doctorate study visa holders in 2019, Iran was a close second. Iranian students made up 15.6 percent of the international doctoral student market.

With 900 study permits, France was also a distant third in the Ph.D. market. This accounted for around 8.5 percent of the market. In 2019, 6.1 percent of French students in Canada pursued Ph.D. degrees.

The United States came in fourth, with India in an unexpected fifth place. In 2019, only 0.5 percent of Indian students in Canada pursued doctorate degrees.

The top ten are as follows:

Students from French-Speaking Countries

As stated in the table above, France is a major source of graduate students for Canada. However, it is not the only Francophone country that sends a big number of students to that level of education.

Algeria and Morocco were also among the top ten nations from which master’s students in Canada came. Tunisia, Lebanon, Benin, and Togo are all weak players in the international student market in Canada, but each sends a large number of graduate students. In 2019, around 30 percent of study permit holders from each of those nations studied at the graduate level in Canada. Quebec is home to more than 85 percent of the graduate students from those countries who traveled to Canada to study.

Graduate programs are the driving force behind many Francophone countries’ contributions to international education in Canada. Furthermore, Canada is a major player in the French-language graduate market, providing Francophones with a unique opportunity to study abroad in their mother language at several world-class institutions.

Looking Beyond the Statistics

With the Canadian institutions’ dedication to producing high-quality programs that are aimed to enhance the employability of students, the country will continue to be the go-to destination for international graduate students.

Apart from the top-notch programs the country has to offer, Canada’s pathways to work and immigration will remain attractive points to individuals not only wanting to further their education but also eyeing to establish careers and live a new life on foreign shores. (SUNEETHA QURESHI)

Suneetha has more than 10 years of experience in the international education sector. As president of MSM GMO, she fortifies its business development outreach globally, particularly in the face of MSM’s foray in edtech-based recruitment via MSM Unify. She preserves the premium, value-adding services provided to each GMO partner institution, including dedicated teams on the ground, agent management, lead generation and inquiry management, application pre-screening, and student and parent support through pioneering pre-departure briefing sessions.

She has an impeccable track record of successfully launching the representative offices in Asia and Africa of many North American and European higher education institutions. Her key strengths include hiring, training, and developing teams as evidenced by the successful results of the dedicated in-country college and university client teams.

Suneetha also has taken the lead in developing several initiatives at MSM, including building robust standard operating procedures, the Rise ‘n Shine team engagement platform, and the organization’s data analytics and audit segments.